First-time homebuyers made up a record share of agency purchase loans in 2023

Housing Wire

MARCH 3, 2024

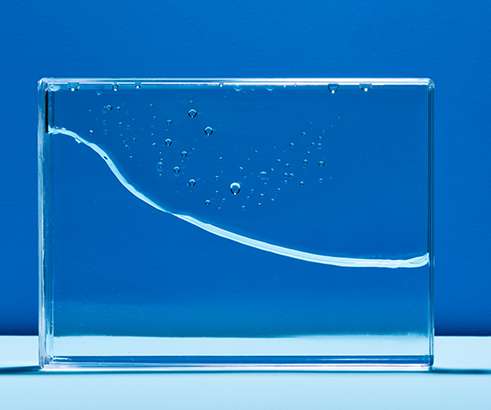

A record 47% of government-sponsored enterprise (GSE) purchase loans in 2023 came from first-time homebuyers, a number that’s been trending gradually higher throughout the past decade. Looking back, last year’s market was dominated by purchase lending, with loans to buy homes making up 82% of a historically low number of originations.

Let's personalize your content