5 Housing Markets Most Vulnerable to a Price Crash: CoreLogic Report

Marco Santarelli

APRIL 22, 2025

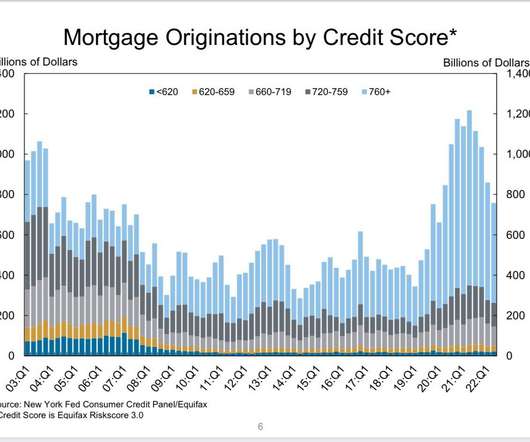

While these 5 markets have a higher risk of decline, most economists aren't forecasting a 2008-style crash across the board. The lending standards today are much stricter than they were back then. It's About Probability: This list identifies markets where the chances of prices falling are higher than elsewhere.

Let's personalize your content