Why industry experts don’t expect mortgage rates to fall

Housing Wire

NOVEMBER 2, 2022

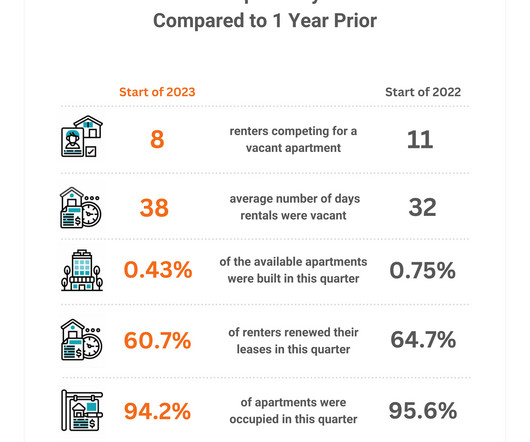

And with Fed rates expected to rise even further, industry experts and economists don’t expect mortgage rates to stabilize for at least another year. Mortgage rates , which are currently near a 22-year high, declined slightly from last week ahead of the Fed’s sixth rate hike announcement. Tables have turned for some sellers.

Let's personalize your content