Foreclosure filings rose in October. Could this trend continue in 2025?

Housing Wire

NOVEMBER 13, 2024

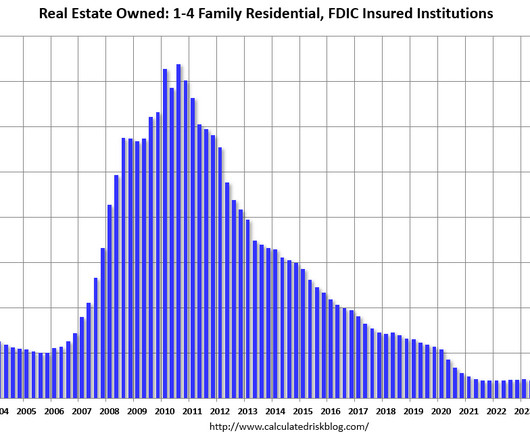

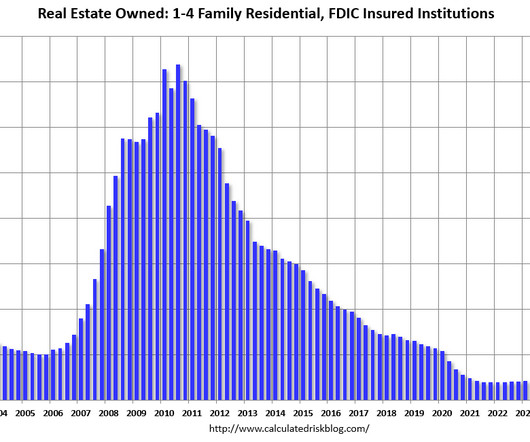

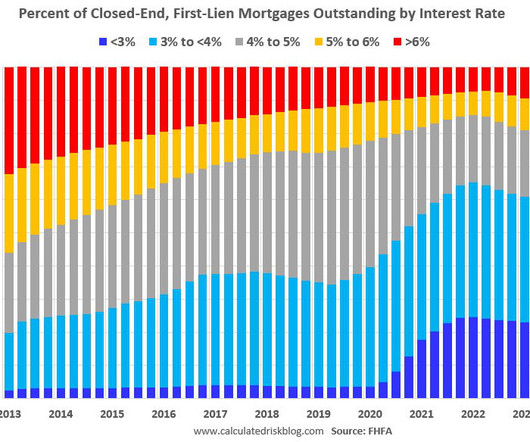

While seasonal factors may slow things down briefly, we’ll be watching closely to see how these recent dynamics affect the market in the coming year.” The report only considers homes in default, auction and real estate-owned (REO) status — i.e., those owned by a bank, government agency or another party after foreclosure.

Let's personalize your content