HUD to double servicer fee on assumable mortgages

Housing Wire

MAY 20, 2024

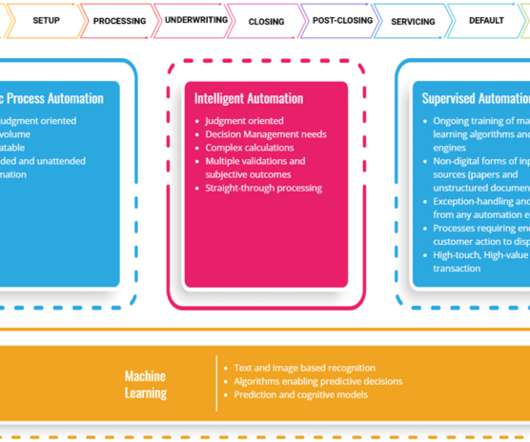

” In an interview with HousingWire during the conference, Todman said that the HUD will soon double the fee servicers can charge for processing, underwriting, and closing a transaction that includes a loan assumption. .” ” There was a “hue and cry,” Todman said. .

Let's personalize your content