Investor Boom Hits Housing Market: Are Bidding Wars Back – Predictions

Marco Santarelli

MAY 15, 2024

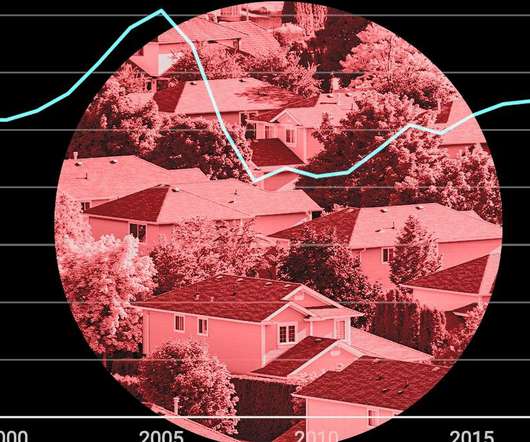

After a period of relative dormancy, investors are returning to the scene, snapping up homes at a slightly increased pace compared to the first quarter of 2023. This marks the first uptick in investor purchases in nearly two years, according to a recent report by Redfin, the technology-powered real estate brokerage. housing market.

Let's personalize your content