HUD walks back some proposed changes to HECM for Purchase program

Housing Wire

APRIL 26, 2024

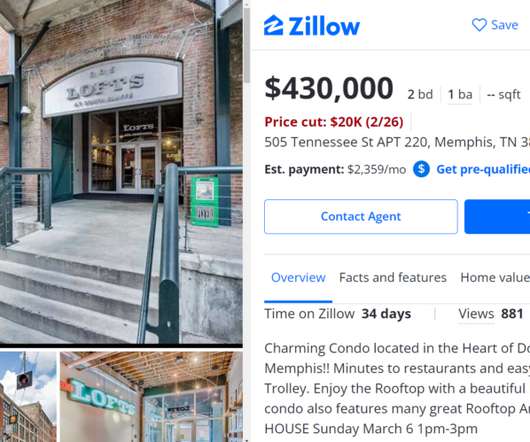

In certain circumstances, the program would allow for inclusion of “an ‘interested party contribution’ [of] up to six percent of the sales price,” according to the original plan. Changing course In October, FHA published proposed guidance for the H4P program in the Federal Register.

Let's personalize your content