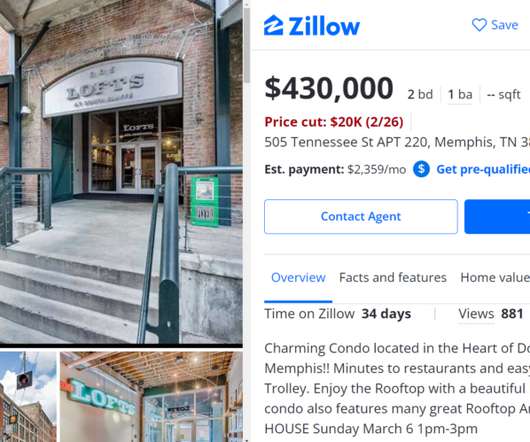

UWM offers two SPCP for first-time homebuyers

Housing Wire

JULY 12, 2023

United Wholesale Mortgage (UWM) on Wednesday announced two new home-affordability mortgage products designed to help underserved borrowers become homeowners. We look forward to working with the enterprises, lenders, and other housing industry participants to further develop the ideas described in these plans.”

Let's personalize your content