CHLA: Lack of competition has driven up third-party closing costs

Housing Wire

AUGUST 1, 2024

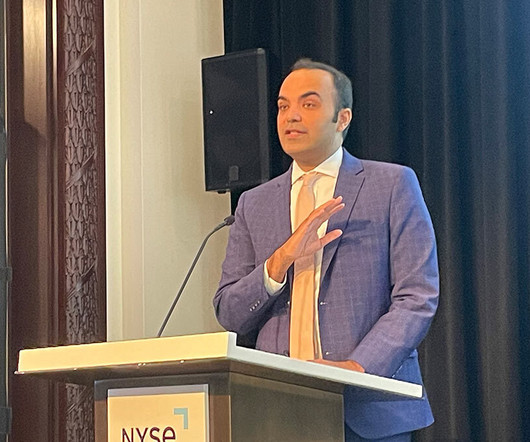

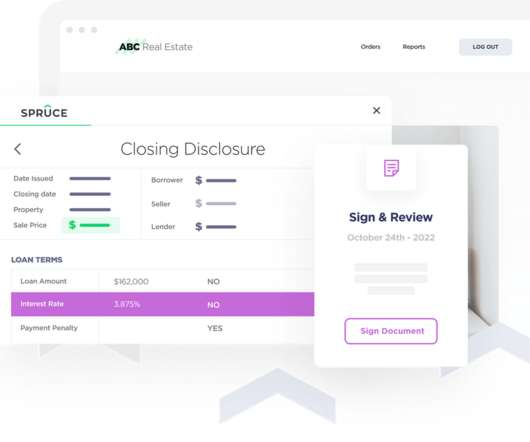

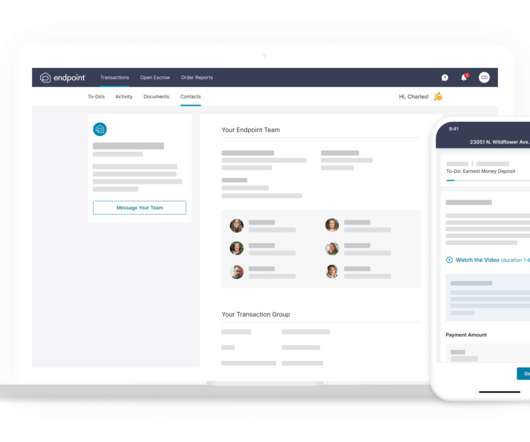

The Community Home Lenders of America (CHLA) on Thursday issued a comment letter to the Consumer Financial Protection Bureau (CFPB), saying that a major reason for the increase in mortgage closing costs from third parties is due to a lack of competition among third-party providers.

Let's personalize your content