Opinion: How the title industry protects homeowners

Housing Wire

FEBRUARY 23, 2023

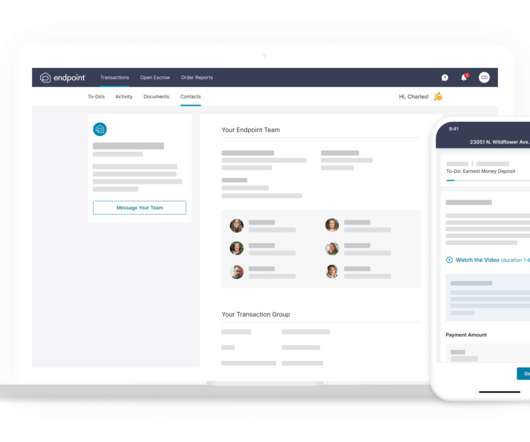

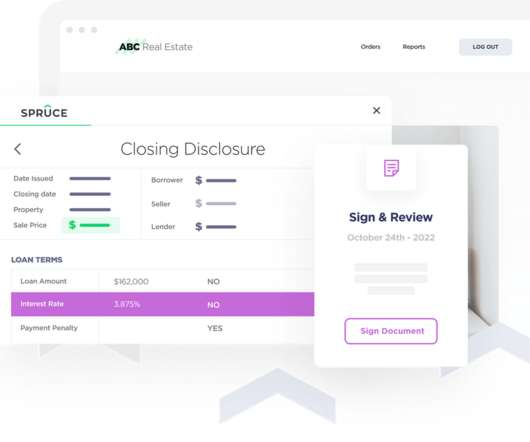

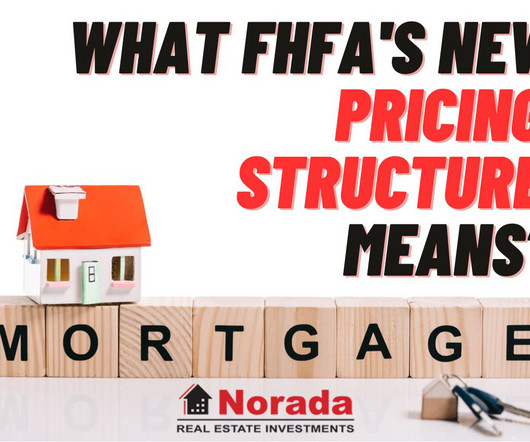

When people think about the title insurance industry , what comes to mind is often its core products – title insurance policies that protect property rights of homeowners and lenders. As an industry, our commitment to protection goes beyond title insurance policies. As an industry, we united against these unfair fee agreements.

Let's personalize your content