The homegenius Platform gives consumers deeper insights in the home buying and selling journey

Housing Wire

NOVEMBER 3, 2023

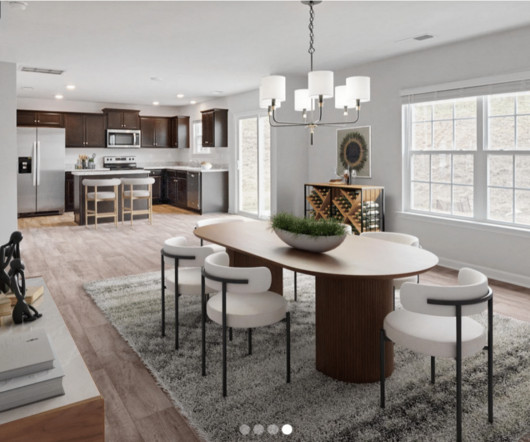

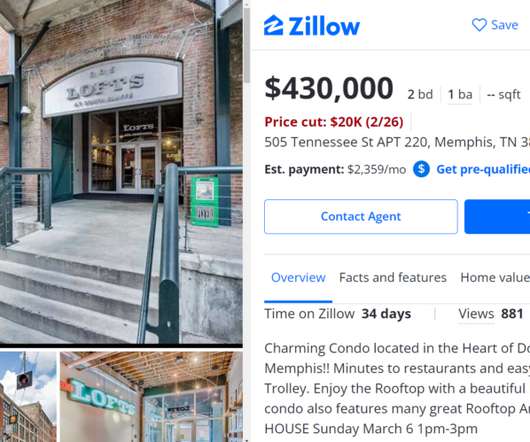

homegenius Real Estate understands the need to deliver differentiated value in a very congested market. Explore possible cost savings. The homegenius Home Price Index combines market information, valuation data and advanced machine learning techniques to analyze home price data and identify trends for regions, towns and neighborhoods.

Let's personalize your content