How to find foreclosure leads and turn them into clients

Housing Wire

AUGUST 5, 2025

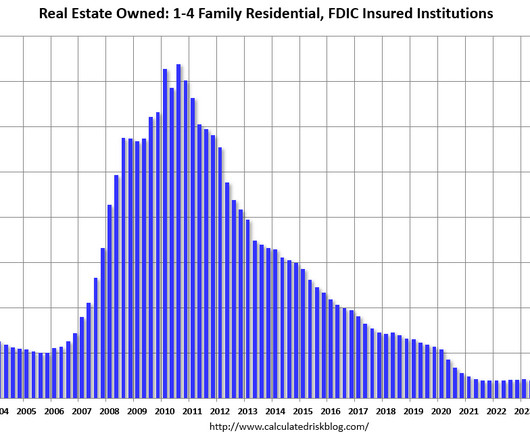

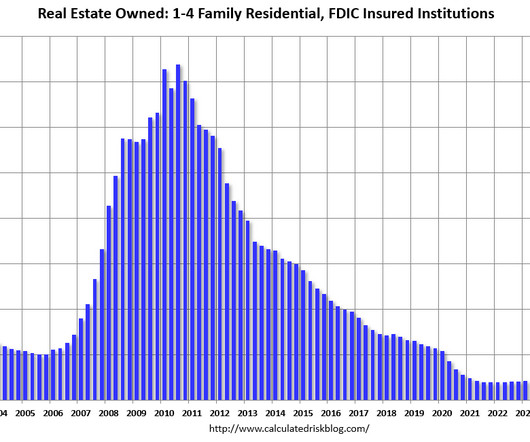

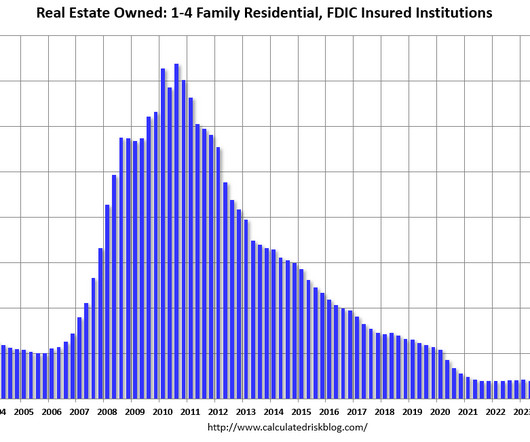

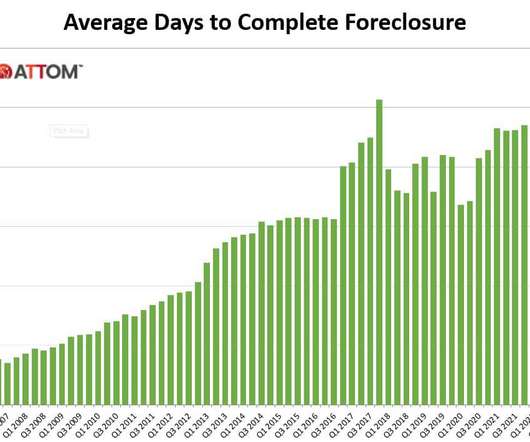

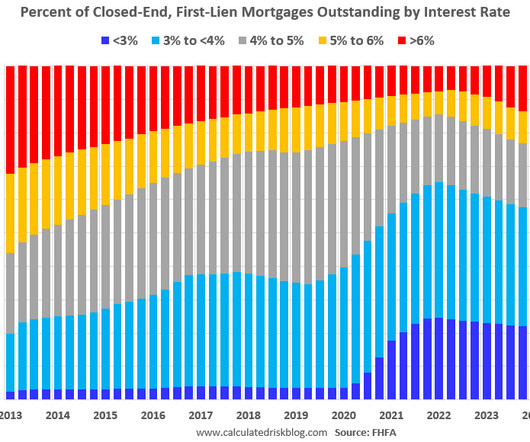

Depending on where they are in the process, they might still be living in the home (also called pre-foreclosure), actively listed for auction or already repossessed by the bank (referred to as real estate owned or REO). Maybe the pricing was off, the condition scared off buyers or the bank just didn’t move fast enough.

Let's personalize your content