Here’s how one CRE veteran helps multifamily investors thrive

Housing Wire

APRIL 10, 2025

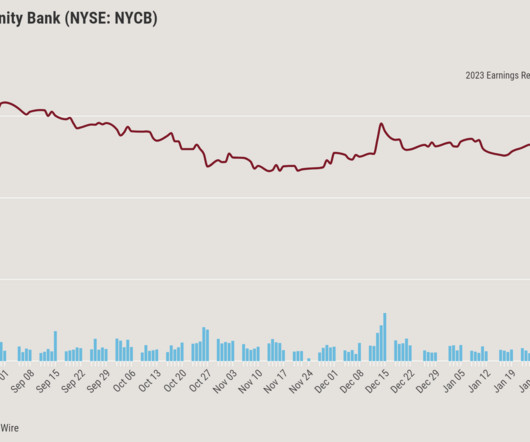

If it isn’t rising interest rates or shifting rental trends, then growing technology is the driving force that prompts investors to evolve. To help investors survive uncertain times, professionals must understand market trends and develop a game plan for success. It is at the intersection of business, banking, and the economy.

Let's personalize your content