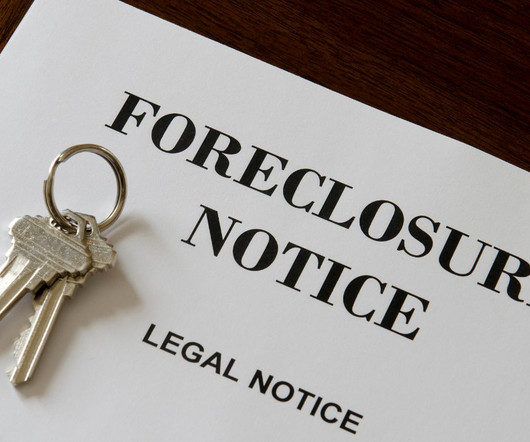

Milwaukee housing authority reportedly ‘misused’ millions in federal funds

Housing Wire

FEBRUARY 3, 2025

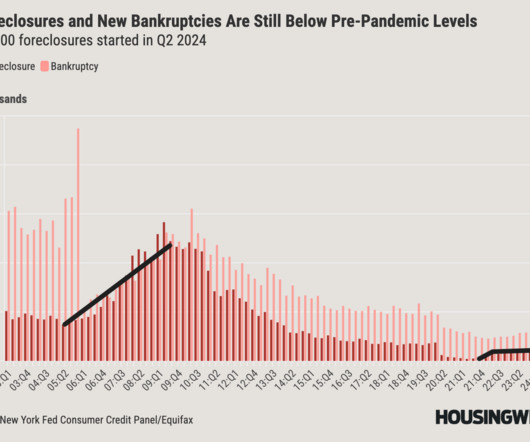

Leak said that without prompt action, HACM could be facing bankruptcy. When asked about this, he made clear that bankruptcy would have been a possibility if the leadership team had done nothing.

Let's personalize your content