Why non-QM borrowers aren’t going away anytime soon

Housing Wire

NOVEMBER 15, 2022

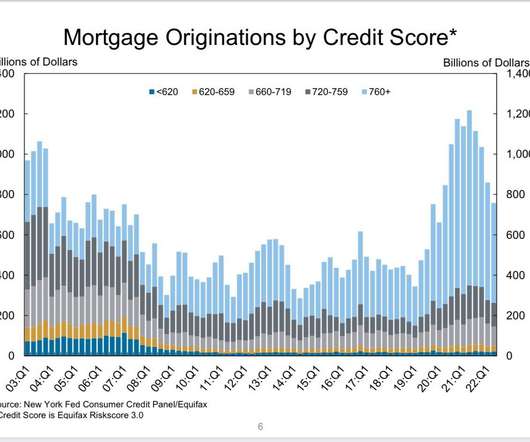

While originations are down due to a volatile mortgage market, the population of underserved borrowers who require non-QM products is on the rise. There will always be a population of borrowers who cannot qualify for a home loan under traditional guidelines. The solution: Bank Statement loans. . Loans up to $1.5

Let's personalize your content