Why equity-tapping challenges may make reverse mortgages ‘inevitable’

Housing Wire

MAY 21, 2024

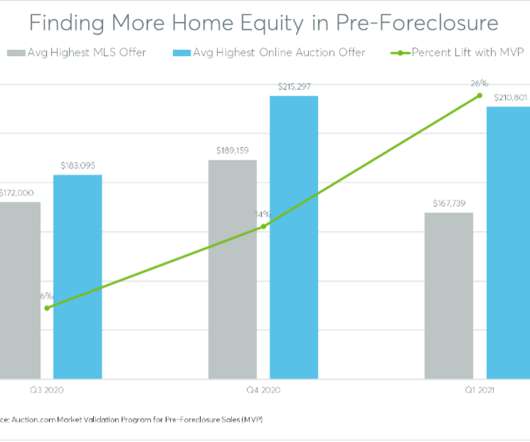

Tapping into home equity , particularly for people in or near retirement , can be challenging — especially for those who may have a pressing need. With this product, eligible people 62 and older can extract equity in a variety of ways, say through a lump sum. But their equity is also a tool. Homes are trophies, sure.

Let's personalize your content