Too Hot, Too Cold or Just “Tight”

Housing Wire

DECEMBER 20, 2022

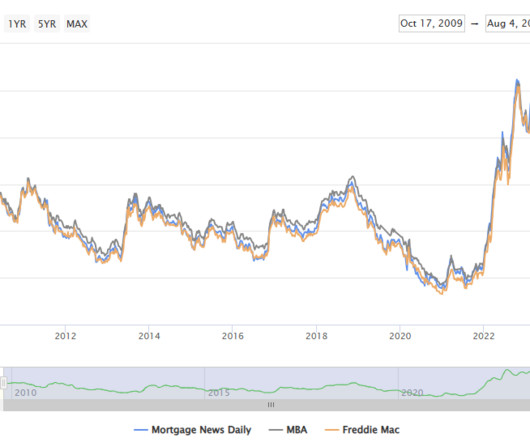

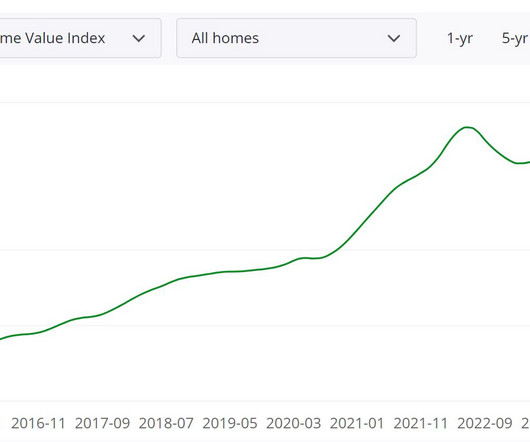

This article is part of our Housing 2022-23 forecast series. It is of little surprise to housing market prognosticators and participants alike that the biggest housing trend in 2022 was the market’s response to the record-breaking increase in mortgage rates, as the Federal Reserve tightened monetary policy to tame inflation.

Let's personalize your content