The state of the homebuilding market

Housing Wire

JANUARY 13, 2023

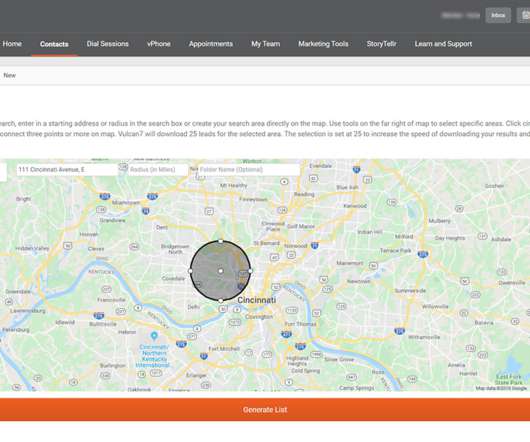

This article is part of our 2022 – 2023 Housing Market Update series. After the series wraps, join us on February 6 for the HW+ Virtual 2023 Housing Market Update. 2022 marked a unique time for homebuilders. Here are a few key factors that are impacting the homebuilding market. Quality Leads.

Let's personalize your content