Housing Market Tracker: Inventory is negative YOY

Housing Wire

JULY 2, 2023

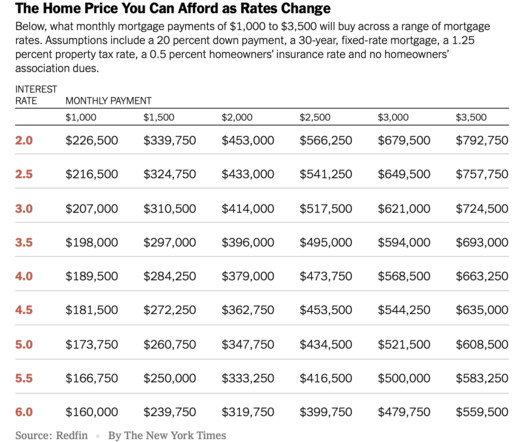

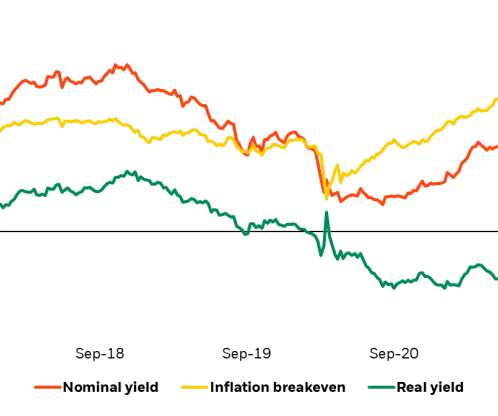

Mortgage rates rose last week after the better-than-anticipated jobless claims data but even with higher rates, we also had a third week of positive purchase application data. As you can see in the chart below, 2023 inventory growth is very slow compared to 2022.

Let's personalize your content