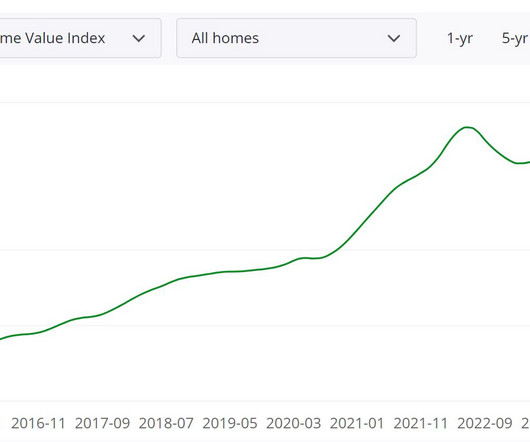

Why fewer homes are taking a price cut, even while inventory rises

Housing Wire

FEBRUARY 10, 2024

While weekly inventory is still falling, we have year-over-year growth in total active listing and new listings data. We might have an average year in housing compared to the past four years! Price-cut percentage Every year, one-third of all homes take a price cut before selling — this is a traditional housing activity.

Let's personalize your content