Why fewer homes are taking a price cut, even while inventory rises

Housing Wire

FEBRUARY 10, 2024

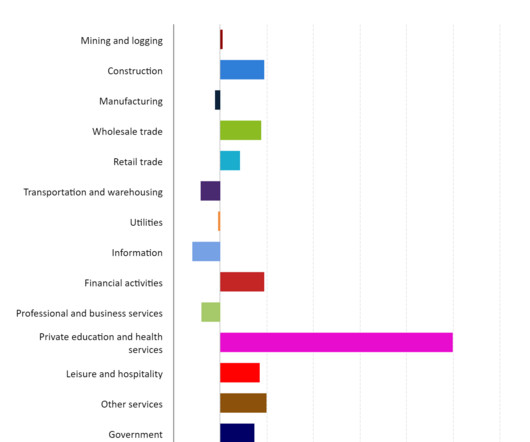

While weekly inventory is still falling, we have year-over-year growth in total active listing and new listings data. This calls into question a mortgage rate lockdown, as mortgage rates are also higher year over year. We might have an average year in housing compared to the past four years!

Let's personalize your content