Why higher rates aren’t crashing home prices

Housing Wire

JUNE 9, 2023

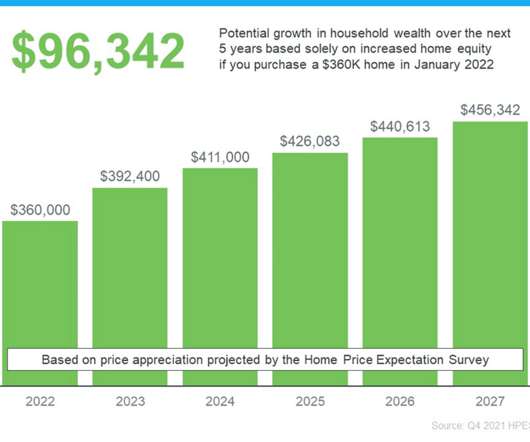

Home prices aren’t crashing, despite what the housing bubble boys are saying. The housing bubble boys are a crew that from 2012 to 2019 screamed housing crash every year. Well, it’s June 9, 2023, and home prices have been firm month to month, not showing anything that resembles the housing bubble crash years.

Let's personalize your content