A repositioning of players in the MSR market is underway

Housing Wire

JANUARY 30, 2024

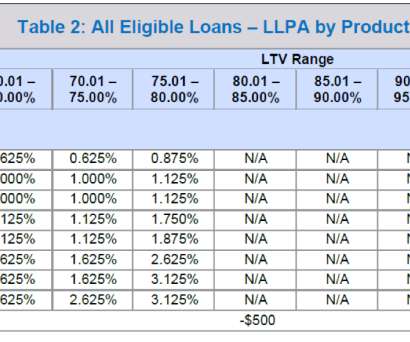

But the MSR market also appears to be in the midst of a rebalancing act marked by the growth of third-party private capital and an overall consolidation of market players, according to some industry experts. The big guys [large IMBs] not only have that [access to capital], but they have strong cash positions as well.

Let's personalize your content