Invest in Long-Term Rental Properties: A Secure Investment Option

Mashvisor

APRIL 20, 2023

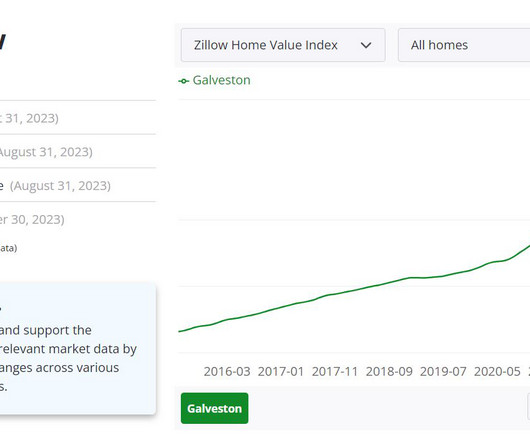

Are you considering investing in real estate and don’t know which strategy to go with? Investing in long-term rental properties might be for you. Rental property investment is one of…

Let's personalize your content