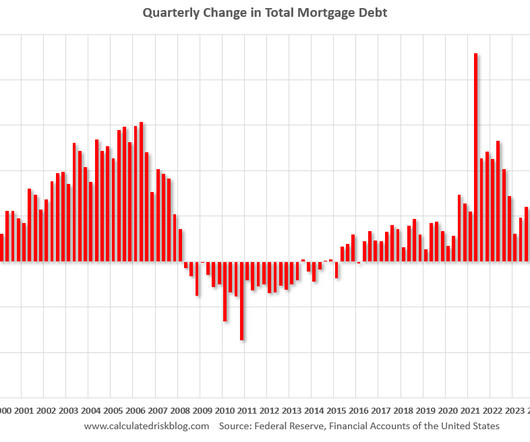

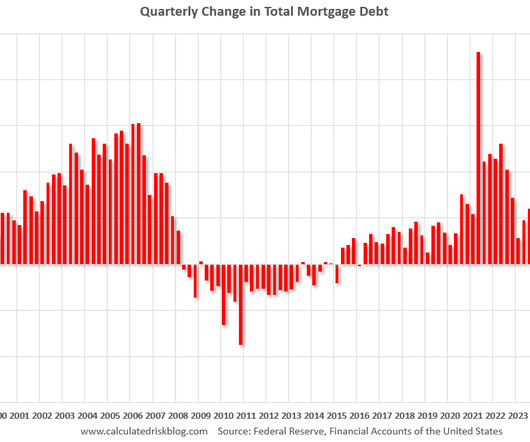

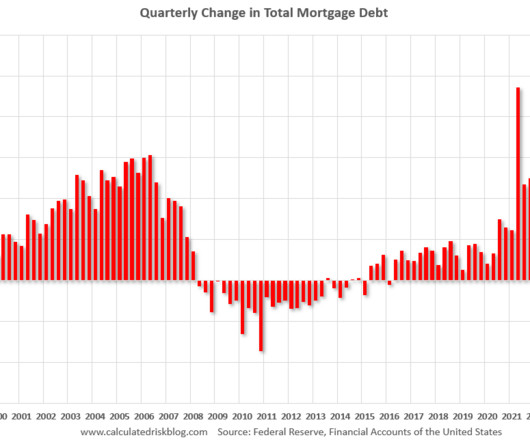

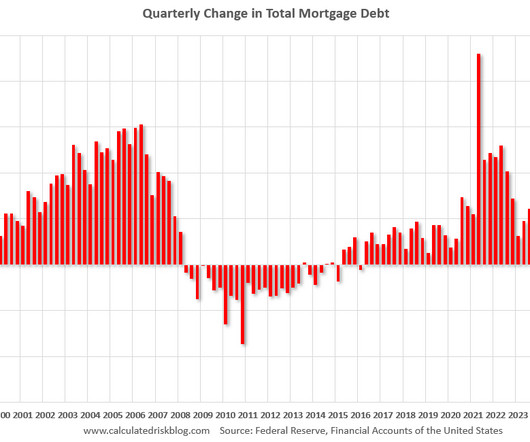

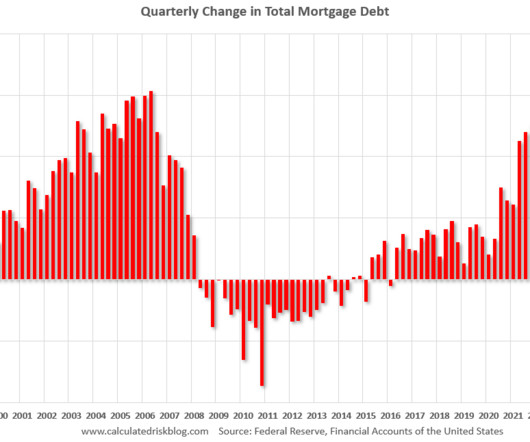

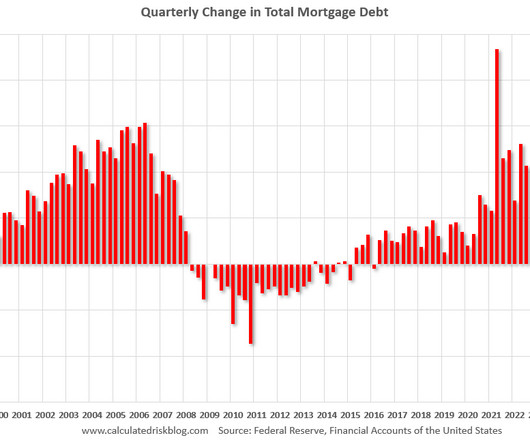

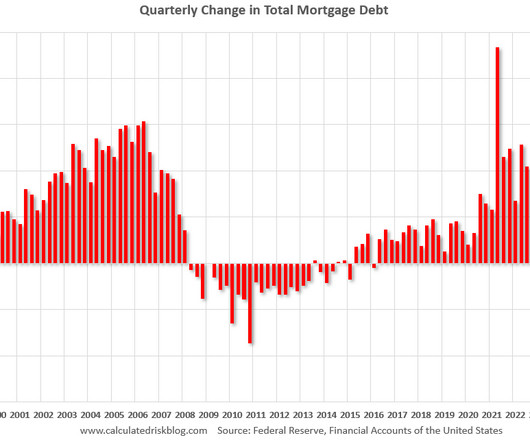

The "Home ATM" Mostly Closed in Q4

Calculated Risk Real Estate

MARCH 13, 2025

emphasis added Mortgage Equity Withdrawal is an aggregate number and is a combination of homeowners extracting equity - hence the name "MEW" - and normal principal payments and debt cancellation (modifications, short sales, and foreclosures). While year-over-year, negative equity increased by 7% from 1 million homes, or 1.8%

Let's personalize your content