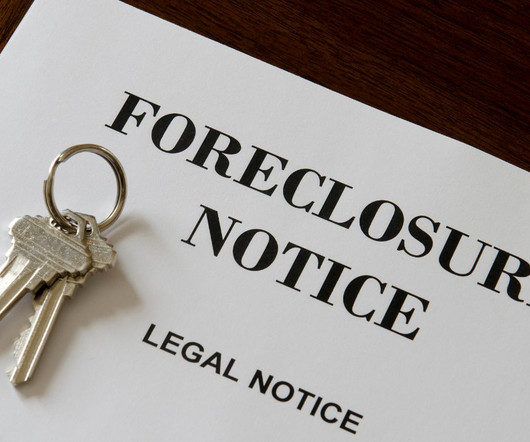

Foreclosure filings rose in October. Could this trend continue in 2025?

Housing Wire

NOVEMBER 13, 2024

With fluctuating mortgage rates and economic pressure in the housing market, foreclosure activity ramped up in October 2024. According to real estate data provider Attom , homebuyers may face more challenges heading into 2025. Attom released its October 2024 U.S. Foreclosure Market Report on Tuesday.

Let's personalize your content