Mortgage rates keep surging after strong inflation reading

Housing Wire

FEBRUARY 22, 2024

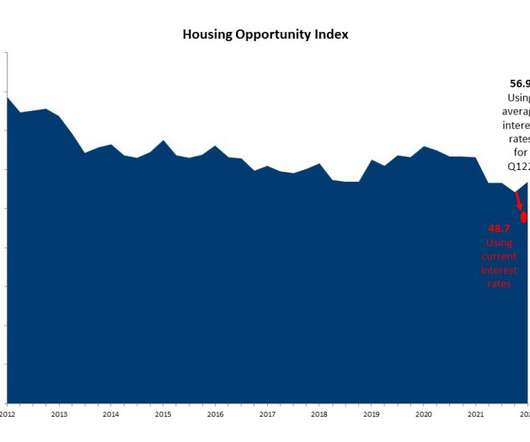

Mortgage rates continued their ascension toward 7% this week, raising doubts about the approaching spring homebuying season. The 30-year fixed-rate mortgage averaged 6.90% as of Feb. 22, an increase from last week ’s figure of 6.77%, according to Freddie Mac ’s Primary Mortgage Market Survey released on Thursday.

Let's personalize your content