Can You Back Out of Buying a House Before Closing?

Redfin

JULY 21, 2025

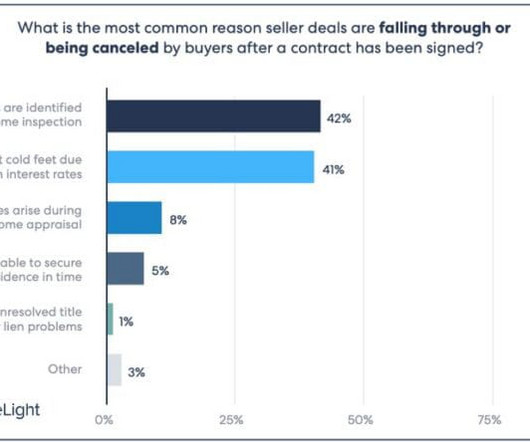

These include contractual protections like contingencies, state-specific allowances like the option period, and financial repercussions such as forfeiting earnest money. Common contingencies include: Financing contingency: Protects buyers if they can’t secure a mortgage loan.

Let's personalize your content