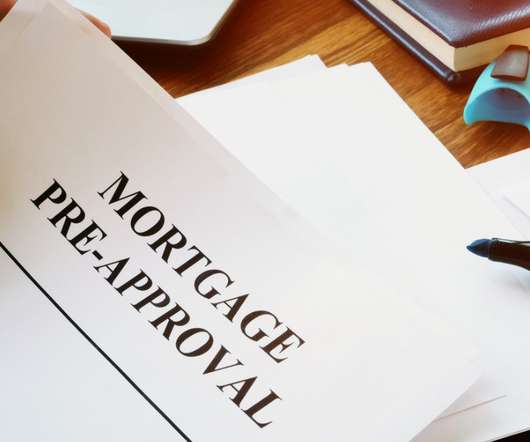

Understanding a Loan Pre-Approval 101

Realty Biz

FEBRUARY 22, 2024

Glossy online listings behind your computer screen might fuel your dream home fantasy, but the home-buying process truly begins in earnest when a lender is contacted to be pre-approved for a mortgage. Once this process is complete, the lender will provide you with a pre-approval letter. When Should You Get Pre-Approved?

Let's personalize your content