When Can a Buyer Cancel a Home Purchase Agreement?

HomeLight

MARCH 7, 2024

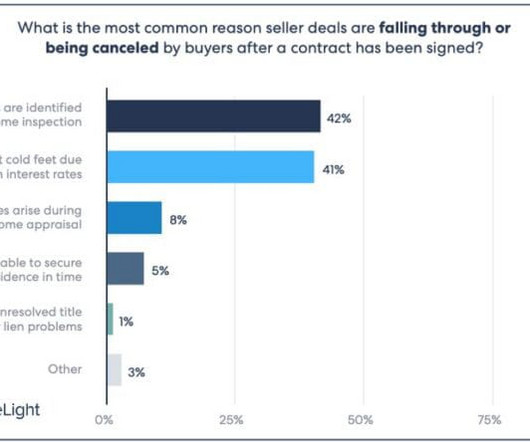

Contingencies: Conditions that must be met for the sale to proceed, such as home inspections, financing approval, and the sale of the buyer’s current home. What is an option period? Negotiation opportunity: Based on findings during the option period, buyers can renegotiate terms or request repairs from the seller.

Let's personalize your content