Top 5 mortgage terms to know before you buy a house

Housing Wire

DECEMBER 22, 2020

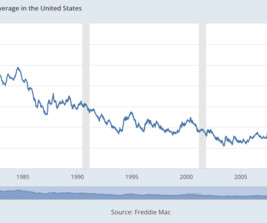

Here are the top five mortgage-related terms you’ll want in your arsenal: 1. Fixed-rate mortgage. There are two types of mortgages: fixed-rate and adjustable-rate. Fixed-rate mortgages have a set interest rate for the entirety of the loan. Pre-approval.

Let's personalize your content