What a tech entrepreneur has discovered about reverse mortgages

Housing Wire

MARCH 29, 2024

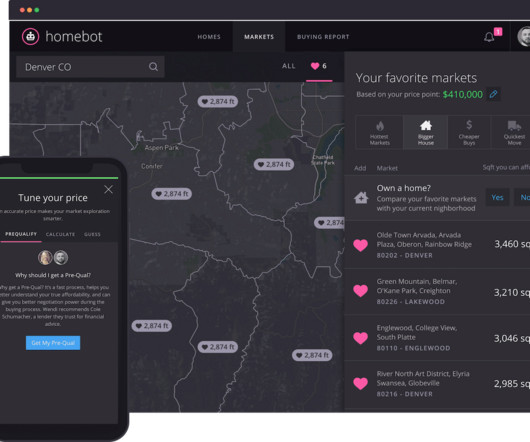

A passion for technology led her to work in the fintech and blockchain spaces, and she has now turned her attention to the senior finance space by founding a company called Graceful Finance. naturally exposing her more closely to the American reverse mortgage industry. But the problem is they’re cash-flow poor in relative terms.”

Let's personalize your content