All-cash transactions gain traction amid high mortgage rates: Redfin

Housing Wire

NOVEMBER 10, 2023

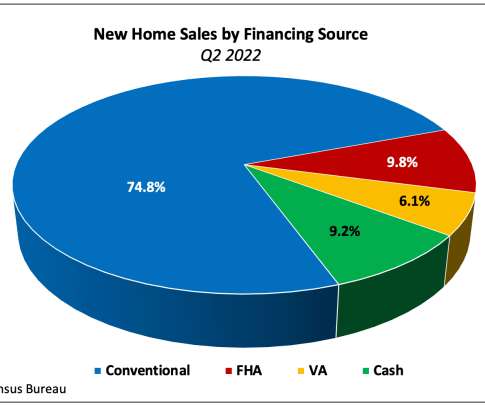

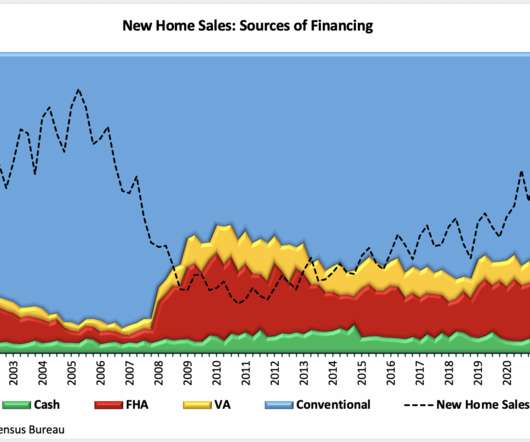

Redfin classified purchases as all-cash when transactions had no mortgage loan information on the deed. High mortgage rates are exacerbating inequality between people who own homes and people who don’t,” Redfin Senior Economist Sheharyar Bokhari said. mortgaged home sales, up from 14% a year earlier but down from 16.3%

Let's personalize your content