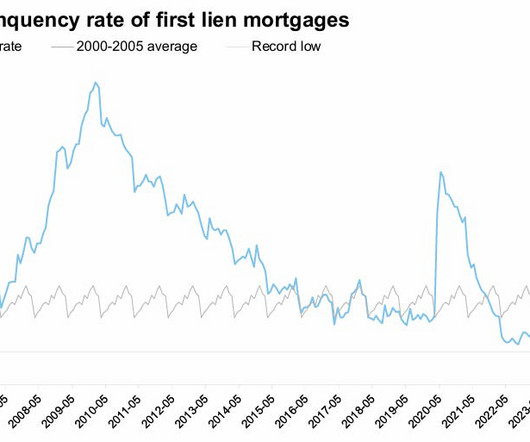

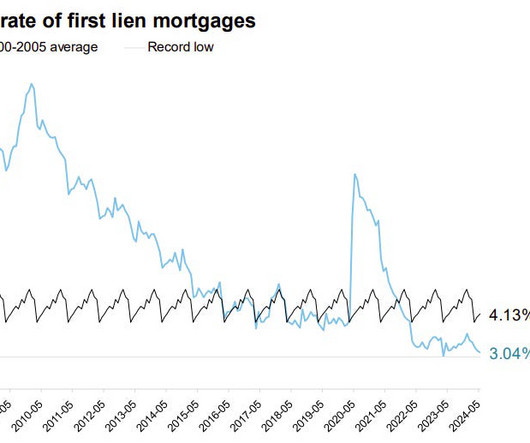

ICE: Student debt, negative equity fuel pockets of mortgage risk

Housing Wire

JULY 7, 2025

That’s according to ICE Mortgage Technology ‘s July 2025 Mortgage Monitor report released on Monday. The resumption of student loan payments and collection efforts on defaulted federal student loans in May, following a five-year pause, could increase financial pressure on some homeowners, according to ICE.

Let's personalize your content