Weaker economy, inflation caused mortgage delinquency uptick in Q4

Housing Wire

FEBRUARY 16, 2023

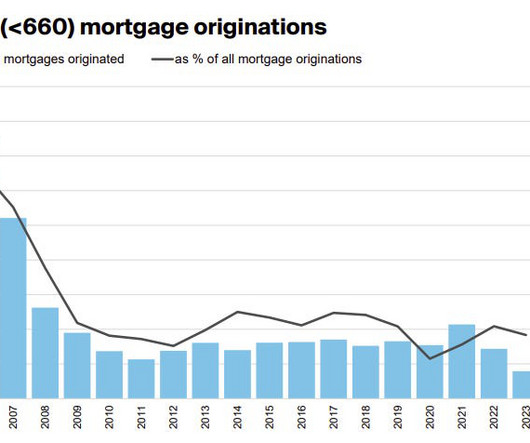

Delinquency rates — which includes loans that are at least one payment past due but does not include loans in the foreclosure process — rose across all loan types and stages of delinquency. The FHA loan delinquency rate rose the most by a whopping 209 bps to 10.61% in the fourth quarter from the previous quarter.

Let's personalize your content