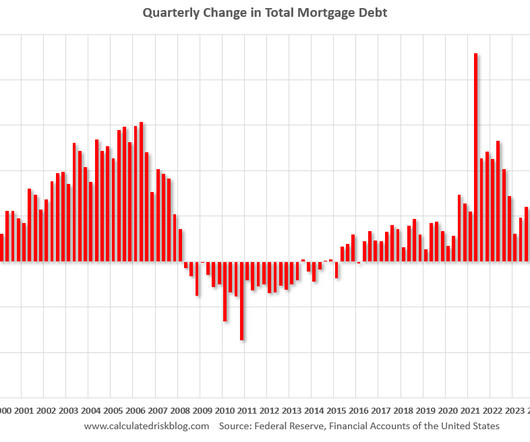

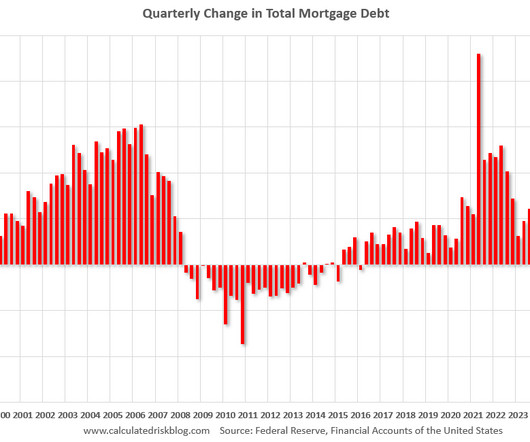

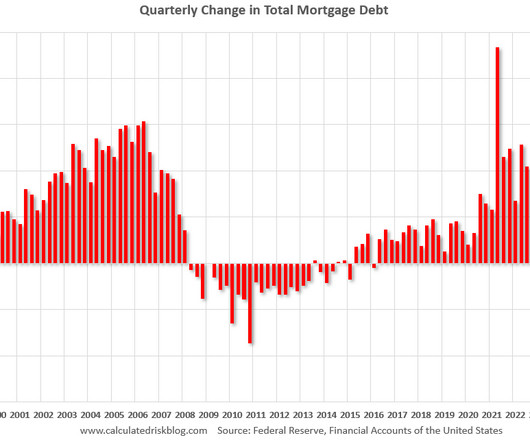

The "Home ATM" Mostly Closed in Q4

Calculated Risk Real Estate

MARCH 13, 2025

During the housing bubble, many homeowners borrowed heavily against their perceived home equity - jokingly calling it the “Home ATM” - and this contributed to the subsequent housing bust, since so many homeowners had negative equity in their homes when house prices declined. million homes or 2% of all mortgaged properties.

Let's personalize your content