Is time the enemy of equity for chronically distressed homeowners?

Housing Wire

FEBRUARY 19, 2024

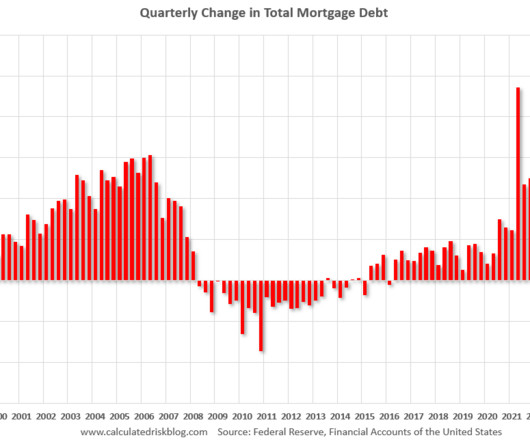

Chronically distressed properties lost more than $7,000 in total home equity on average while cycling in and out of foreclosure, according to an Auction.com analysis of more than 80,000 properties scheduled for foreclosure auction multiple times in the last three years.

Let's personalize your content