Deephaven’s Tom Davis: ‘Either you take market share, or someone takes yours’

Housing Wire

JANUARY 30, 2025

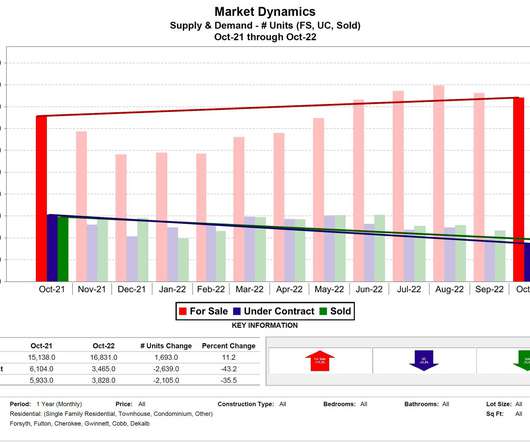

For example, 30% of purchase transactions were new construction last year. If you’re a loan officer, you should have a construction product that focuses on builders, developers and Realtors. And, its focusing on areas like construction, non-QM, the fix-and-flip and second lien production.

Let's personalize your content