Better improves loan volume by 25% but remains unprofitable in Q1

Housing Wire

MAY 14, 2024

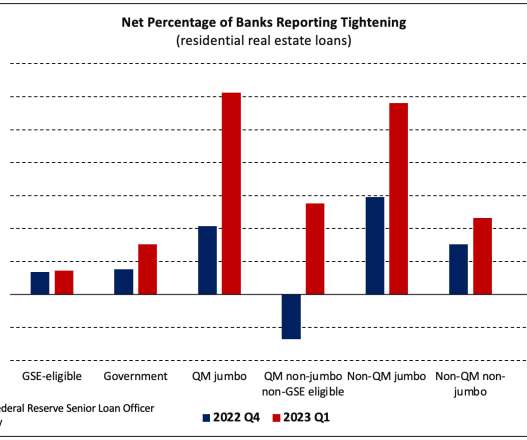

Better Home & Finance Holding Co. , million, driven mainly by home equity line of credit (HELOC) and cash-out refinance products, executives said. Funded loan volumes came in at $661 million, up 25% quarter over quarter. Purchase loans comprised 80% of the funded volume, followed by refinances (12%) and HELOCs (8%).

Let's personalize your content