2 Things Sellers Need To Know This Spring

Keeping Current Matters

MARCH 8, 2023

A lot has changed over the past year, and you might be wondering what’s in store for the spring housing market.

Keeping Current Matters

MARCH 8, 2023

A lot has changed over the past year, and you might be wondering what’s in store for the spring housing market.

Housing Wire

MARCH 8, 2023

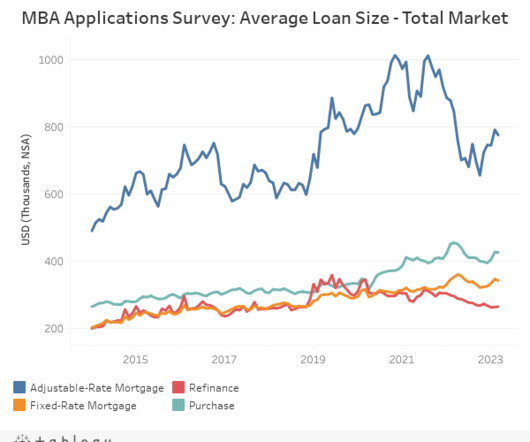

It’s counterintuitive but real: Despite surging mortgage rates , borrowers’ demand for home loans rose last week. There were very low levels of mortgage applications in the weeks prior to the surprising uptick. However, a surge in demand for government loans and adjustable-rate mortgages (ARMs) played a role in last week’s increase.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Real Estate News

MARCH 8, 2023

Lawsuits aren't just a risk for large, national firms. Brokerages of all sizes are exposed to legal and regulatory threats and need to be proactive.

Housing Wire

MARCH 8, 2023

Chicago-headquartered lender Guaranteed Rate has expanded its program to approve loans within 24 hours nationwide. Dubbed the “ Same Day Mortgage ,” the program is aimed at giving a competitive edge to first-time buyers who are competing against the all-cash buyers who make up 28% of home purchases, the lender said. The program first rolled out to a select group of customers in 2022, resulting in $1.1 billion in closed loan volume, according to the lender.

Advertisement

Ready to better your Back Office? Dive into the secrets to a powerhouse back office with Brokermint expert, Jessica Souza. In this free download, she shares her 3 transformative hacks designed to clean house, get everyone on the same page, and set yourself up for success. From optimizing agent profiles to ensuring flawless transactions and boosting agent retention, these strategies are your ticket to a seamless operation.

Real Estate News

MARCH 8, 2023

Housing completions went up in 2021, but builders tapped the brakes in 2022. At the same time, more households formed, leading to an ongoing shortage.

Housing Wire

MARCH 8, 2023

The 2023 mortgage industry merger-and acquisition wave has hit New Jersey. Two lenders based in the state are negotiating a deal: AnnieMac is in talks to acquire Family First Funding , according to former employees and business partners. More merger and acquisition deals are expected to happen as mortgage rates surge to the 7% level and origination volumes decline even further.

Residential Realty Today brings together the best content for real estate professionals from the widest variety of industry thought leaders.

Housing Wire

MARCH 8, 2023

Homebuyers and sellers are being cautious due to current market conditions, as indicated by Fannie Mae ‘s home purchase sentiment index (HPSI). The HPSI — which tracks the housing market and consumer confidence to sell or buy a home — decreased 3.6 points in February to 58.0, breaking a streak of three consecutive monthly increases, according to Fannie Mae.

Inman

MARCH 8, 2023

The CEO of construction tech startup Welcome Homes thinks builders will have to take risks to prevent a massive affordability crisis, the likes of which haven't been seen since the early 1980s.

Housing Wire

MARCH 8, 2023

The Consumer Financial Protection Bureau (CFPB) on Wednesday released a special edition of its Supervisory Highlights report that profiles “unlawful junk fees uncovered in deposit accounts and in multiple loan servicing markets,” including among mortgage servicers. “For years, junk fees have been creeping across the economy,” said CFPB Director Rohit Chopra.

Inman

MARCH 8, 2023

In remarks at Morgan Stanley's Technology, Media and Telcom Conference Tuesday, CEO Robert Thomson said growing Realtor.com after its sale to CoStar fell through is a "personal priority.

Advertiser: Trellis

Trellis is a state trial court research and analytics platform that provides Real Estate Professionals (Buyers, Foreclosure, Loan Modification, etc.) with LEADS on Pre-Foreclosures, Lis Pendes, Distressed Assets and more — to help uncover **new** opportunities and grow their business. The process is quick and easy — and all in real time. Trellis will supply you with a link to the relevant dockets, a Leads sheet and access to its UI where applicable.

Housing Wire

MARCH 8, 2023

Ohio-headquartered Park National Bank will pay $9 million under a settlement with the U.S. Department of Justice (DOJ) to resolve allegations that it discriminated against Black and Hispanic neighborhoods in the Columbus area. The complaint, filed in federal court in the U.S. District Court for the Southern District of Ohio last month, alleged that Park National failed to provide mortgage lending services by redlining majority-Black and Hispanic neighborhoods in the Columbus area from at least 2

Inman

MARCH 8, 2023

In this bootstrap economy, knowing how to capture professional pictures and videos of your listings could save you thousands in marketing expenses. Marketing expert Latham Jenkins shares his pro tips for using your iPhone to capture stunning, high-quality footage.

Housing Wire

MARCH 8, 2023

As expected, California-based mortgage lender loanDepot reported another unprofitable period in the fourth quarter of 2022, its third consecutive quarterly loss. The red ink resulted from declining mortgage production and came despite the company’s decision to exit the wholesale channel , trim its workforce , and invest in new products. The rough Q4 underscores the fact that loanDepot’s “Vision 2025” plan, which includes rightsizing its operations, will take many quarters

Inman

MARCH 8, 2023

It can be challenging to discern meaningful data from the rest. Still, it's vital to grow your social media efforts effectively. You want to avoid what's called "vanity metrics" and measure the metrics that mean something.

Advertisement

Navigated 360° tours, like YourVRTours, advance pipelines by engaging clients further along the sales funnel. These immersive experiences provide comprehensive property insights, increasing buyer intent and readiness. By embracing navigated tours, agents can optimize property exposure, better qualify leads, and streamline the sales process. Stay ahead in the ever-evolving real estate landscape with innovative technology that elevates buyer journeys and progresses pipelines more effectively.

Housing Wire

MARCH 8, 2023

Six former employees are suing New Jersey-based Family First Funding, LLC and its three co-founders in a class-action-seeking lawsuit claiming the lender failed to pay them overtime. The plaintiffs worked as processors at the company in different periods from May 2018 through January 2023. The regular workday, according to them, was supposed to follow business office hours from Monday to Friday.

Inman

MARCH 8, 2023

Inman's first-ever Intel leadership survey revealed that leaders think the market will be worse in 2023 compared to 2022 — but they also expect to thrive regardless of the economic headwinds.

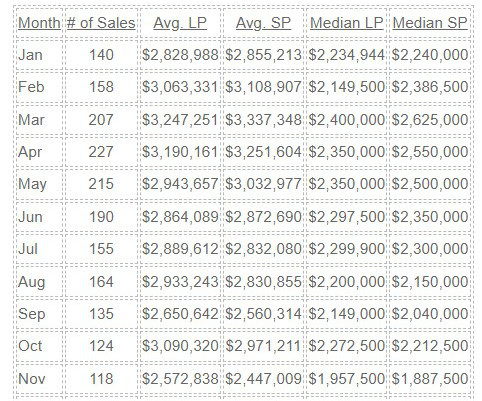

BubbleInfo

MARCH 8, 2023

I’m not going to get crazy-optimistic just because the over-list percentage more than doubled MoM, or because last month’s median sales price was 11% higher than it was a couple of months ago. I’m just happy that the number of sales appears to have bottomed out.

Inman

MARCH 8, 2023

Sens. Elizabeth Warren, Bernie Sanders, Tina Smith and Edward Markey said they investigated rental data firm RealPage and call for more scrutiny of the company’s role in nationwide rent growth.

Speaker: Sarah Santa Ana, Real Estate Coach, Move4Free Realty

Networking is one of the crucial elements in every real estate organization's success. Both agents and real estate companies need to maintain robust networking links. This is why social media is essential for any real estate professional! Social media enables you to stay in touch with your present clients, maintain connections with your past clients, and engage potential customers and investors.

Eye on Housing

MARCH 8, 2023

Per the Mortgage Bankers Association’s (MBA) survey through the week ending March 3rd, total mortgage activity increased 7.4% from the previous week and the average 30-year fixed-rate mortgage (FRM) rate rose eight basis points to 6.79%. The FRM rate has risen 61 basis points over the past month. The Market Composite Index, a measure of mortgage loan application volume, rose.

Inman

MARCH 8, 2023

The CFPB alleges mortgage servicers charged excessive late fees, assessed "fake" private mortgage insurance premiums and made homeowners pay for unnecessary inspections.

Broke Agent Media

MARCH 8, 2023

BAM Key Details: Housing sentiment, as measured by the Fannie Mae Home Purchase Sentiment Index, dropped 3.6 points to 58.0 in February, breaking its three-month streak of increases and pulling the index closer to its all-time low set in October 2022. Four of the six HPSI components declined month over month, specifically those having to do with job security and whether it’s a good time to sell In February, the Fannie Mae Home Purchase Sentiment Index dropped 3.6 points to 58.0, officially brea

Inman

MARCH 8, 2023

Zillow's Listing Media Services product is now available in Houston, Jacksonville, San Diego, Phoenix, Chicago and San Francisco, the search portal announced Wednesday.

Speaker: Trey Willard, Realtor/Team Leader at Keller Williams Realty, Inc.

In order to create continued success in today’s real estate market, realtors need to utilize an arsenal of technology that will increase their efficiency and presence on social media. Using technology to manage your prospects and tap into their needs through websites, social media, and other channels is critical for real estate success in 2022 and beyond.

Maximum Exposure Real Estate

MARCH 8, 2023

What Credit Score Do I Need to Buy a Home? Are you interested in the minimum credit score needed to buy a house? Over my thirty-seven years as a real estate agent, many potential buyers have asked me, “what credit score do I need to buy a house.” It is one of the most common […] The post Minimum Credit Score to Buy a House appeared first on Maximum Real Estate Exposure.

Inman

MARCH 8, 2023

Fannie Mae's National Housing Survey shows Americans are feeling less secure about keeping their jobs, and nearly 8 in 10 think it's a bad time to buy a home.

Propmodo

MARCH 8, 2023

The idea of rent control may be making more headlines lately, but it’s far from a new idea. The history of rent control in America dates to World War I, where, between 1919 and 1924, several cities and states adopted the policies. Rent control was also widespread during the Great Depression and World War II-era housing shortages, though not all states adopted it.

Inman

MARCH 8, 2023

The agents join Compass from Berkshire Hathaway HomeServices and boast at least 25 years of experience in the industry, Compass exclusively told Inman.

Advertisement

Curious as to how you could do 18% more business? How about 14 more transaction sides per year? Check out this infographic with data from a RealTrends study to learn more.

Real Trends

MARCH 8, 2023

Agents, stop letting your deals die. Stop giving up so easily. Deals go sideways for many reasons, so there are many solutions to solving these issues. Use this guide to get your transactions back to the closing table and don’t give up. What do you do when your buyer’s financing is denied? Whether it’s your buyer or the buyer on your listing, there are solutions you can turn to.

Inman

MARCH 8, 2023

Inman’s Marketing All-Stars is a nod to the most effective, creative and boundary-pushing marketing professionals in the real estate community.

Windemere Selling

MARCH 8, 2023

Your local market conditions dictate the real estate climate around you. Where things are on the buyer’s/seller’s market spectrum will impact how you and your Windermere real estate agent approach selling your home. As a part of this process, it’s important to understand the different types of markets and how their conditions play into accurately pricing your home.

Inman

MARCH 8, 2023

Futures markets are taking the Fed chair at his word that policymakers may have to hike rates faster and take them higher to combat inflation

Speaker: Mary Maloney, Founder & Team Leader at Hometown Realty

The sales cycle in real estate is frequently measured at 3+ months. During this time, real estate agents frequently lose contact with clients and miss out on opportunities because they fail to follow up and provide value to the client. Top real estate agents are distinguished from developing agents by their ability to convert organic connections into sales opportunities.

Let's personalize your content