What Is a Mortgage Contingency? Purchase Offer Protection

HomeLight

DECEMBER 12, 2023

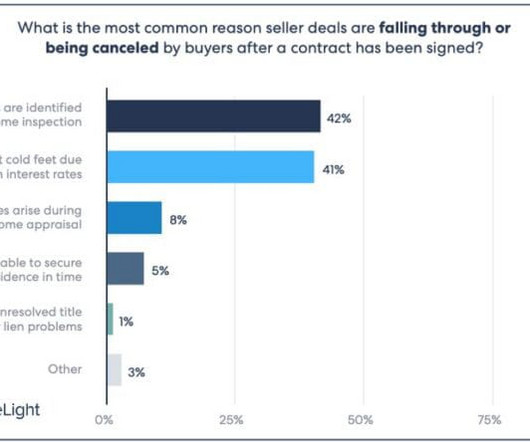

Perhaps the biggest gear that needs to turn in your favor is the mortgage loan. A common worry among homebuyers is to find the perfect house, put down a deposit with an accepted offer, and then learn that your mortgage application is denied — you lose both the house and your earnest money.

Let's personalize your content