What Is a Mortgage Contingency? Purchase Offer Protection

HomeLight

DECEMBER 12, 2023

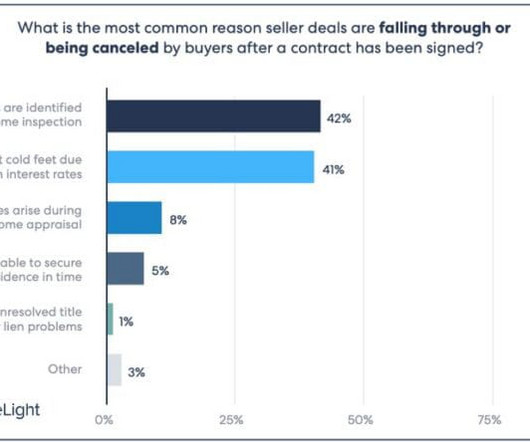

A mortgage contingency protects you in such situations, ensuring that you’re not left holding an empty bag if the financing falls through. These typically include the amount of time you have to secure financing and the acceptable terms of the mortgage (like interest rate and loan type). Essentially, it’s a safety net.

Let's personalize your content