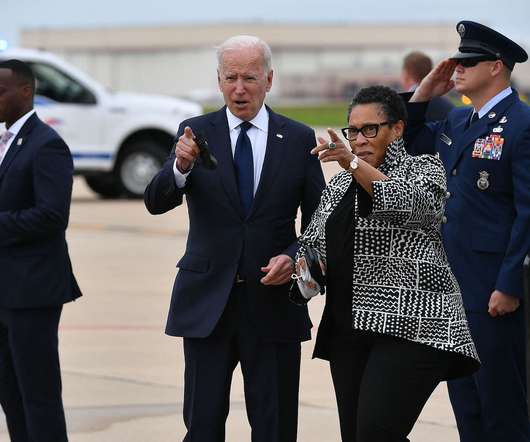

HUD secretary suggests openness to changing FHA ‘life of loan’ requirement

Housing Wire

JANUARY 17, 2024

Department of Housing and Urban Development (HUD) Marcia Fudge suggested to a congressional committee that the department could consider eliminating life-of-loan premium requirements for mortgages backed by the Federal Housing Administration (FHA), but did not offer any indication about the issue’s priority level at HUD.

Let's personalize your content