2025 labor market holds key for mortgage rates

Housing Wire

MARCH 7, 2025

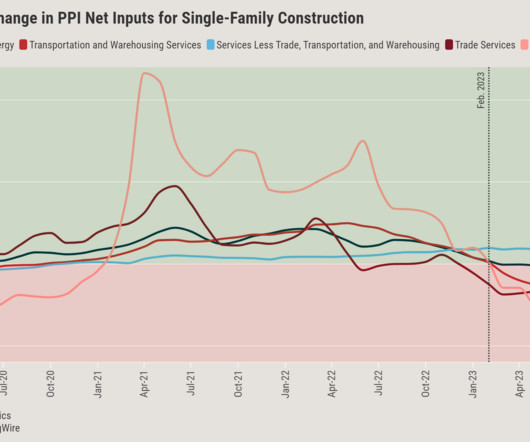

Today, the BLS jobs report showed that the labor market is getting softer, but it’s not breaking. This gives us a glimpse of what may happen over the next 10 months for mortgage rates, especially since, since Jan. This leads us back to the private sector and residential construction jobs.

Let's personalize your content