Retirees may be turning to home equity to finance healthcare shocks: report

Housing Wire

FEBRUARY 24, 2025

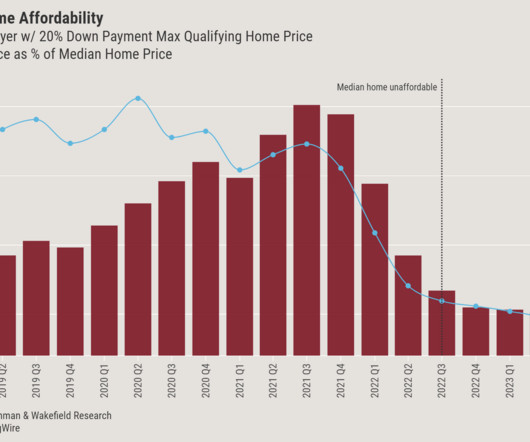

While many retirees often do not intend to tap their home equity to finance such moves, they may often end up doing so. But they remain largely exposed to LTC expenditures, leading some to go against their expectation and to tap their homes equity to cover these costs. Such shocks also lead to reductions in expected bequests.

Let's personalize your content