Bring your borrowers home: How speed and simplicity will win the next refinance wave

Housing Wire

MAY 6, 2025

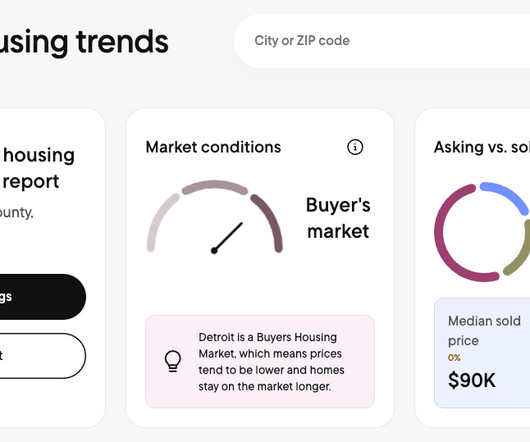

A shifting market demands a faster response Many borrowers who locked in loans over the past few years are sitting on tappable equity and watching the market closely. When rates dipped, applications jumped but the window closed just as quickly. Lenders must be ready to engage borrowers instantly, or risk losing them for good.

Let's personalize your content