11 mortgage lead generation ideas to build your client base

Housing Wire

JULY 11, 2025

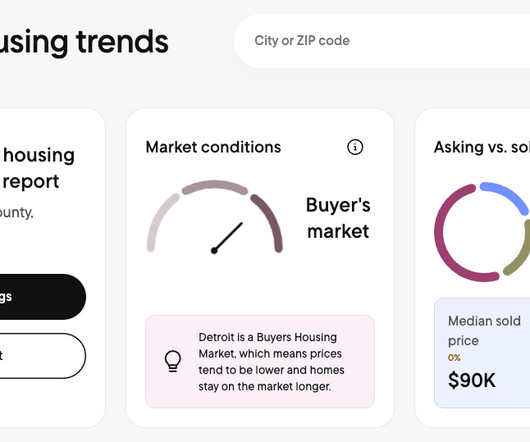

All of these professions come into contact with individuals who are buying homes and could need a loan. Loan officer profile visible to leads (Source: LendingTree ) Want leads fast? From there, they complete qualification forms and are given loan options and lenders, like you, who can help them. Check out LendingTree.

Let's personalize your content