The mortgage industry braces for (more) FICO price hikes

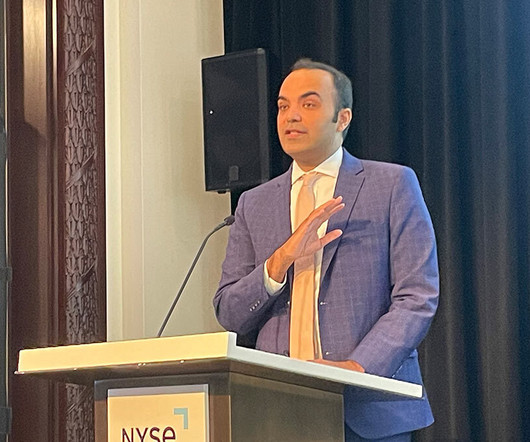

Housing Wire

OCTOBER 31, 2024

In the halls of the Colorado Convention Center on Monday, it was hard not to overhear mortgage bankers gnashing their teeth over the rumored price hikes for Fair Isaac Corp (FICO) scores. per score to all mortgage lenders, independent of their volume. Wall Street expects new cost increases in 2025 and 2026. What will it cost?

Let's personalize your content