‘Find buyers before agents!’ Mortgage industry reacts to the NAR settlement

Housing Wire

MARCH 15, 2024

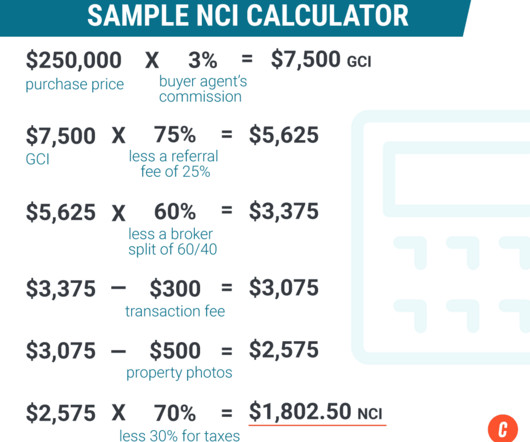

Loan officers and mortgage executives expect home sellers and homebuyers to negotiate more aggressively on commission paid to buyer agents, potentially bringing costs down. He shows up for open houses and teaches courses at real estate brokerage firms, which allowed him to build relationships with agents throughout his career.

Let's personalize your content