5 lessons we learned at the HW Economic Summit – and why we consider it a ‘must attend’

Housing Wire

MARCH 24, 2025

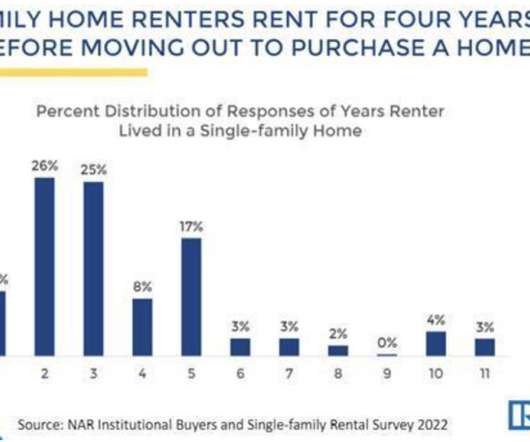

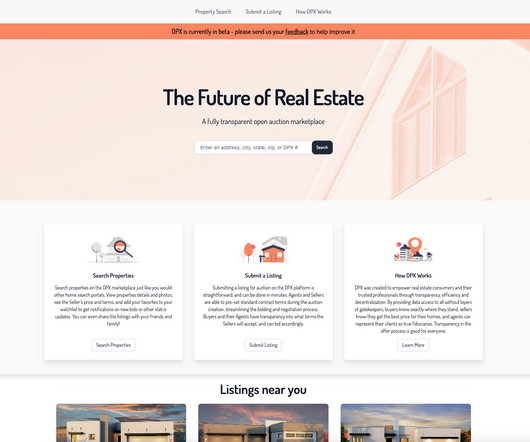

With economists, analysts and industry leaders in the room, discussions revolved around key economic indicators, inventory shifts, technology advancements and what lenders should be doing right now to prepare for the next cycle. Additionally, rate buy-down incentives are playing a major role in helping move new home inventory.

Let's personalize your content